when are draftkings tax forms available

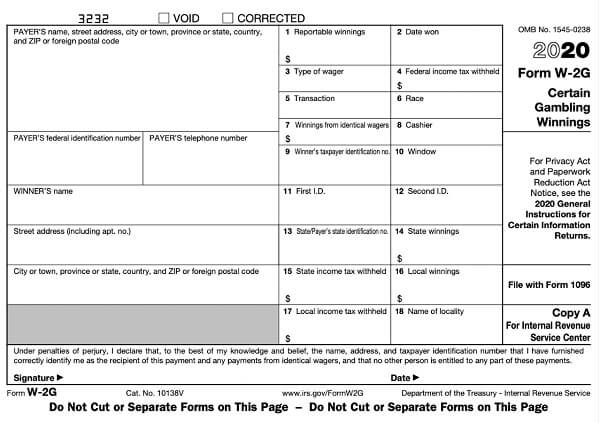

Depending on the actual state you live in DraftKings will report your winnings after a certain amount. How do I opt in to electronic-only delivery of tax forms 1099 W-2G from DraftKings.

Draftkings Tax Form 1099 Where To Find It How To Fill

This is standard operating procedure for daily and traditional sports betting sites and is one of the requirements for DraftKings and sites like it to stay in.

. Daily Fantasy Sports Contests With No Season Long Commitment. If you have winnings of over 600 from any Daily Fantasy Sports site such as FanDuel or DraftKings you will likely receive a Form 1099-MISC with the amount shown on Box 3. This is calculated by the approximate value as prizes won - entry feesbonuses.

Please advise as to where I input this other income that is not considered gambling however it was gambling winnings. If you qualify to receive tax forms from DraftKings IRS Forms 1099W-2G you can access the information directly from the Document Center. 6 rows Forms 1099-MISC and Forms W-2G will become available online prior to the end of February IRS.

How do I opt in to electronic-only delivery of tax forms 1099 W-2G from DraftKings. Anyone know when they are usually available in the tax document area on the site. However if you havent received yours dont worry.

To ensure that DraftKings has the correct information for your tax forms please visit the DraftKings Tax ID form to confirm or update your details. Normally I withdraw my money with no issue but Draftkings is making me fill out a form for taxesanyone else having to do this. DraftKings is required to issue 1099 tax forms to any player who has a cumulative net profit in excess of 600 for the calendar year.

Key tax dates for DraftKings - 2021 Where can I find my DraftKings tax forms documents 1099 W-2G. Ask them for a W8BEN form and fill it out. SPORTS Live Sports Betting Odds.

The only place I see where a 1099-MISC is applicable is Small Business Self employed which is not what my DRAFTKINGS form is from. Jokerswild22 4 years ago. For Oregon activity please contact the DraftKings Customer Support team as the information in this article may not apply to you.

Ad Up to 500 Deposit Bonus to a Daily Fantasy Sports Contest. So I fill out a W8BEN form print it out sign it take a picture of it and send it to Draftkings support with. Tax Return Access.

Good news they are available for download online. Hillfamily5 4 years ago. Draftkings 1099 form for 2021.

How do I update personal information on my tax forms 1099-Misc W-2G for DraftKings. Play for Free Today. Has anyone heard any updates on draftkings releasing the 1099 forms this year.

I think you have to do one after 600 profit. Daily Fantasy Tax Reporting. You do have to pay taxes on your Cumulative Net Profit from fantasy sports.

You can expect to receive your tax forms no later than February 28. You may be required to pay both federal and state income tax. To confirm or update tax forms via desktop laptop or mobile web.

Win Big Cash Prizes. Included with all TurboTax Free Edition Deluxe Premier Self-Employed TurboTax Live TurboTax Live Full Service customers and access to up to the prior seven years of tax returns we have on file for you is available through 12312023. According to Draft Kings the accounting department processes withdrawals each Monday through Friday at 9 AM to 5 PM ET.

Why am I being asked to fill out an IRS Form W-9 for DraftKings. Tax form on DraftKings. This article covers how you get your DraftKings sportsbook tax form in addition to how you fill in your DraftKings tax form.

1099s are usually sent by the end of January but many still wait for their DraftKings 1099 forms which support has been saying will arrive in 2-4 weeks. You can log on to your account to find your form today. DraftKings is introducing that.

How do I update personal information on my tax forms 1099-Misc W-2G for DraftKings. Most players should have received after February 1st but if you havent received yours there is another way to retrieve yours online at the DraftKings Document Center. Still waiting for your DraftKings 1099 forms in the mail.

Draftkings has this written regarding taxes. Also how long does it take DraftKings to give you your winnings. Terms and conditions may vary and are subject to change without notice.

At the moment unfortunately DraftKings is not profitable and is not positive in cash flow from operations but they do expect to be adjusted EBITDA profitable in. Why am I being asked to fill out an IRS Form W-9 for DraftKings. Key tax dates for DraftKings - 2021 Where can I find my DraftKings tax forms documents 1099 W-2G.

After you do that you should have no problem withdrawing your with no tax withheld. Fantasy app customers can update their IRS Form W-9 via desktop laptop or mobile web. If you receive your winnings through PayPal the reporting form may be a 1099-K.

We should mention that most bettors should have received their DraftKings 1099 forms in the mail after February 1st. Ive read they usually ask for an extension but I have not seen any updates. The answer is yes your cumulative net profit is taxed and DraftKings is contractually required to send a 1099 tax form to any player that nets of 600 in profit in a calendar year.

Draftkings Ontario Promo Code And Sportsbook Review 2022

Draftkings Canada Ontario Sportsbook App Promo Code

Draftkings Ontario Promo Code And Sportsbook Review 2022

Draftkings Ontario Promo Code And Sportsbook Review 2022

Draftkings Sportsbook Is Offering No Juice Nfl Spreads Crossing Broad

/cdn.vox-cdn.com/uploads/chorus_image/image/69721003/DK_Nation_1800x1200_6.0.png)

Nft Explained What Are Nfts And How Do They Work In The Draftkings Marketplace Draftkings Nation

Draftkings Fanduel Legal States Where Is Dfs Allowed

How To Make A Draftkings Deposit Guide Banking Options

Draftkings Begins New Era With Official Launch Of Sportsbook In New Jersey Business Wire

Draftkings Online Sportsbook App Review Best Offers In Ny La Az

Terms Of Use Draftkings Sportsbook

I Joined Draftkings Last Year And Now I Have No Idea How To File My Taxes Am I Screwed R Draftkingsdiscussion

Draftkings Tax Form 1099 Where To Find It How To Fill

Is Draftkings Legal Is Playing On Draftkings Sportsbook Dfs Legal

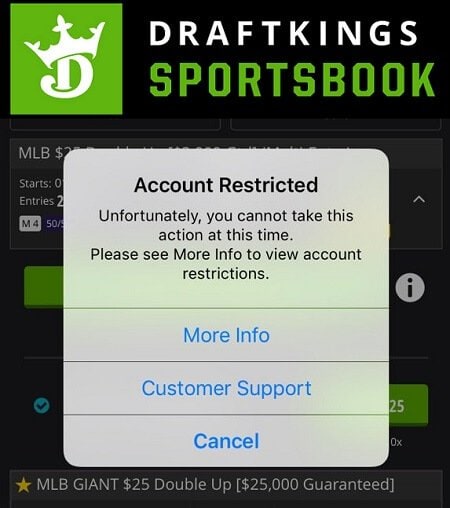

Restore Restricted Or Locked Draftkings Sportsbook Account

Draftkings To Pay 325k In Class Action Settlement Top Class Actions